Updated May 13, 2025

Originally published Jul 8, 2024

Also check out our Sustainability Terms Glossary, where we’ll add key terms from each of our Deep Dives over time. Bookmark this page for future reference!

Updates as of May 2025

The packaging EPR landscape is rapidly changing in the U.S., so we have provided some updates here on new states with EPR laws, timelines as we know them today, and challenges producers have encountered. Given that the implementation of EPR laws is evolving so quickly, it is difficult to keep this blog post up to date with the latest. See the “Keeping Up with EPR News” section below for a list of websites that are regularly updated.

Key Takeaways

- Packaging EPR requires producers (usually brands) to pay fees based on the amount of type of packaging they sell into the state.

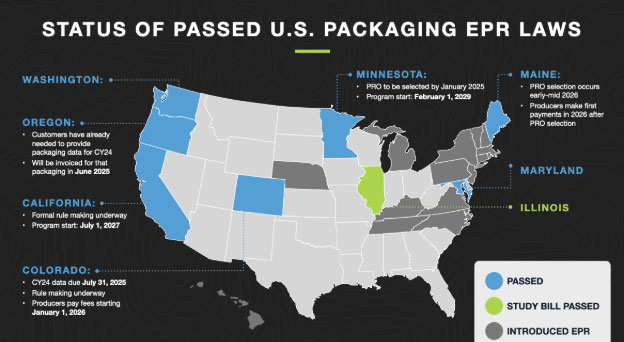

- Seven U.S. states have passed packaging EPR laws.

- The Circular Action Alliance (CAA) is the Producer Responsibility Organization (PRO) assigned thus far to manage these EPR programs and collect fees.

- Producers were required to report their 2024 packaging data for Oregon by March 31, 2025. The next deadline is for Colorado reporting, due July 31, 2025.

- Companies should be conducting EPR reporting now and working to reduce and improve their packaging now to reduce fees.

If you have an interest in packaging policy or sustainable packaging, you have likely heard the term “EPR” or “extended producer responsibility.” But what exactly is EPR, and how will it ultimately affect the types of packaging we use? In this Deep Dive, we will explore the current EPR landscape in the U.S. and what is likely to come over the next several years.

A note of caution: this post is intended as an overview of packaging EPR with some basic advice for companies navigating the new legislative landscape. It should not be taken as legal advice, and we recommend that companies who believe they are regulated “producers” seek legal counsel to better understand their responsibilities.

Introduction to EPR

Extended Producer Responsibility, or EPR, refers to a policy approach that shifts the responsibility for waste management of a given product from consumers/taxpayers and municipalities onto the producers of that product. Typically, the main goal of EPR is to minimize the environmental externalities of a product’s end of life – that is, minimize the costs of the unintended consequence of what happens to a product when we’re done with it. EPR prompts a society to start thinking on a large scale about where products end up when we’re done with them and incentivizes companies that produce regulated products, in this case packaging, to minimize their environmental impacts upstream.

EPR regulations have been around for years in the U.S. to manage products like e-waste, mattresses, paint, tires, and batteries. Let’s take the example of paint to illustrate EPR in action. “Producers,” meaning paint manufacturers, are typically responsible for the paint up until the point where you, the consumer, purchase it. But there are some unintended consequences that come when you’re done with that paint can that likely has extra paint in it. While most paint is actually recyclable if collected properly, many people throw it away or pour it down the drain, which can contaminate the environment and water supplies with hazardous chemicals. Ultimately, consumers/taxpayers and the environment pay the costs to deal with this result, and paint companies don’t have an incentive to fix it.

This outcome is obviously not ideal, so many states introduced paint EPR in the early 2000s. Now, 12 states have paint EPR laws that create systems for producers to take back leftover paint and facilitate the responsible disposal of paint to reduce those negative environmental outcomes. In policy or economist lingo, we’d call EPR a way to prompt producers to “internalize the environmental externalities.”

The concept of EPR first began in Europe in the 1990s, then Canada formalized EPR for packaging in 2009, and now the wave of packaging EPR has come to the U.S. We will dive deeper into which states have adopted EPR for packaging legislation and their timelines later.

The Concept Behind Packaging EPR

In the paint example above, consumers/taxpayers (used interchangeably in this piece) were the ones fronting the costs for the improper disposal of paint. The same thing is happening with packaging today. As our current system stands, consumers are the ones paying for the disposal of packaging through taxes and fees which go to waste haulers and local governments that fund our trash pickup, landfilling, recycling services, litter management, and more. There are a variety of unintended consequences, including the plastic pollution crisis that Atlantic and A New Earth Project talk about frequently. There simply are not enough economic incentives in place to discourage landfilling or littering and encourage packaging reduction, reuse, and recycling.

Packaging EPR aims to create some of those incentives. Under packaging EPR (which we’ll just call “EPR” for the remainder of this Deep Dive), the producers will be partially or fully responsible for the cost of disposal, whether that be trash, recycling, composting, etc. (Don’t worry – we’ll get into more detail about who the “producers” are later.)

But what does that “responsibility” look like? It can take two basic forms: financial and operational.

When producers have “financial responsibility” under EPR, they basically take on the cost of paying for responsible disposal of packaging. This likely includes paying for waste collection, more recycling services, composting, and landfilling, as well as programs to prevent litter. As a reminder, this would be instead of, or in addition to, the local municipalities and taxpayers funding the collection and disposal of packaging. Producers fund their financial obligation by paying fees into a system based on the amount of and type of packaging they sell into the regulated state. Those fees then reimburse municipalities for their waste management costs. Sometimes, financial responsibility explicitly means funding improvements to the waste management system (e.g., upgrading recycling centers), as opposed to reimbursing municipalities for their day-to-day waste management costs.

With “operational” responsibility, producers actually play a role in the day-to-day collection and disposal/recycling of materials. This may look like running take-back programs or starting up new recycling and compost services. In EPR laws in the U.S. so far, we largely have seen programs set up for producers to have both some financial and operational responsibility for packaging’s end of life. However, the mix of financial and operational responsibility looks a little different in each state.

Remember: one of the main points of packaging EPR is to create incentives for producers to manage packaging’s end of life so that there are fewer externalities (costs from unintended negative consequences) that fall on taxpayers and the environment. So when producers have to take some responsibility – financial, operational, or both – for the packaging’s end of life, their incentives change. Firstly, they want to use less packaging because they’ll pay fewer fees into the system. Then, for the packaging they do use, they’ll want to use more recyclable packaging because it usually comes with lower fees (more on this later). Lastly, they’ll have incentives to design and use packaging that is compatible with take-back or recycling/composting programs that they’re responsible for funding or operating.

As of this writing, seven U.S. states have passed EPR for packaging legislation. Maine and Oregon passed first in 2021, with Colorado and California following in 2022. In May 2024, Minnesota signed the fifth bill into law. In 2025, Maryland moved from just having a study bill” in place to passing full EPR, and Washington state’s legislature passed EPR too.

Illinois has also passed a “study bill,” which is a “pre-EPR” law where the states decide to do extensive studies on what the state’s recycling system needs. Illinois does not have scheduled dates by which they will impose fees on producers.

Now, we’ll dive more into some of the elements of packaging EPR that help create these incentives.

Elements of Packaging EPR

The Producers

Who counts as a producer under EPR?

Typically, the “producer” of a piece of packaging is the brand whose name appears on the packaging, not the actual manufacturer of the packaging itself. The idea here is that the brand is the one that makes the decision about what kind of packaging to use, and thus, they have the market power to demand different packaging materials or designs. However, there are some exceptions to this rule, and different states/schemes may have slightly different criteria for producers based on whether they’re a U.S.-based company, if they’re a distributor or private label, their role as a retailer, etc. There are too many caveats to go into here for the different states’ laws, but just remember that typically, the producer is the one whose brand is on the package. To see if you’re an obligated producer for each state, you’ll need to consult the EPR statute (the bill that becomes law) in that state. There are often useful flow charts for each state that walk you through who the obligated producer is for a product.

It’s important to note that “producers” don’t need to be based in the regulated state: if they are selling product into the regulated state, they are likely an obligated producer under that state’s law.

States typically have small business exceptions. Each state has a minimum threshold based on the amount a company sells within the state. For example, if a company is selling over $1 million worth of product per year in California, they will likely be an obligated producer, but a company selling less than $1 million would be exempt, regardless of where that company is based. This threshold is different for each state.

What are the covered products/packaging types?

In the language of EPR laws, “covered materials” are the products that are subject to recycling targets and fees. Packaging that is considered “covered material” under EPR schemes in the U.S. typically includes any separable, distinct component used for the containment, presentation, and/or protection of a product from a producer to a consumer, especially single-use plastic packaging and, often, food service ware. This may include cardboard inserts, stickers, cardboard boxes, poly bags, food and beverage containers, foil and wraps, straws, utensils, and more. As such, covered materials typically include primary, secondary, and tertiary/logistical packaging, along with disposal food service ware. However, covered products may differ between states. For example, Colorado’s EPR laws don’t reference packaging used for the presentation of a product (stickers, etc.). Please see our resources at the end of this deep dive for links to state-specific covered materials.

Remember: producers are not paying fees on their actual product, but rather the packaging around that product. The “covered materials” refer to the types of packaging that are regulated.

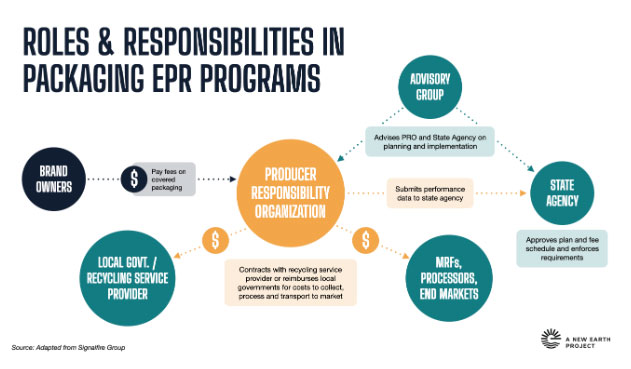

The Producer Responsibility Organization (PRO)

An EPR program is managed by a Producer Responsibility Organization (PRO) (often said as “P-R-O” or as a word “pro”), which is typically a non-profit run by the producers. The PRO, which may also be called a Stewardship Organization, must be appointed by the state, and the PRO and the state agency work together to make the EPR program successful. Some key producers will start a PRO, and then other producers can join the PRO to comply with the law.

Each year by a deadline outlined in statute, producers submit data to the PRO about how much and what type of packaging they sold into the state based. Each state has its own list of covered materials as mentioned above, and the producers are prompted to provide the weight of each of those materials that they used to package all of their products sold into that state the previous reporting period. Based on those data, the producers each pay fees to the PRO according to a fee schedule negotiated between the PRO and the state.

The PRO then uses these fees to execute a “program plan” for that state, which is essentially an agreement between the PRO and the state about how funds will be used to reimburse municipalities for their costs and/or improve waste management infrastructure. The actual EPR law (statute) outlines some key performance targets that the PRO is responsible for achieving, such as a recycling rate target. While the PRO – run by the producers – has the license from the state to operate the program, theoretically powered by private sector efficiencies, the PRO is ultimately accountable to the state. If the state does not believe the PRO is sufficiently operating the program within the bounds of the law, the state can terminate the PRO’s role.

In the U.S., it is most common for the PRO to need to be a non-profit organization. This is not required as often in Europe. Additionally, in the U.S., typically there can only be one PRO per state, although not always.

Who is the PRO?

The PRO can theoretically be a different organization in each state. However, thus far, the Circular Action Alliance (CAA) has been named as the PRO in each state that has appointed one. We expect it will continue to be named as the PRO in other states, basically operating a “franchise” model. CAA is a 501(c)(3) nonprofit founded by 20 companies, including Amazon, Coca-Cola, Keurig Dr. Pepper, Mars, and many more in response to the rise of EPR laws. Again, to comply with the laws, producers must register with the PRO and sign state-specific addenda delineating their responsibilities. (There are often pathways for producers to report and pay fees directly to the state without joining the PRO, but this is rare in practice.)

Who is “the state”?

When we have mentioned “the state” or “state agency” thus far, we mean some state-specific agency ultimately reporting to the Governor of that state. Each EPR law delineates who the relevant agency is who will set regulations and administer the law. For example, in California, the California Department of Resources Recycling and Recovery (“CalRecycle”) is that agency. In Oregon, the Department of Environmental Quality (“Oregon DEQ”) does this.

The Advisory Board

Each state typically selects a Producer Responsibility Advisory Board (though names differ between states) consisting of a variety of affected and knowledgeable stakeholders. The Advisory Board works to identify the challenges, opportunities, and nuances to developing EPR, advising the PRO and the state on law implementation. Atlantic Packaging’s President, Wes Carter, sits on the Advisory Board for the PRO in California, representing Atlantic as the only packaging company on the board. Advisory Boards will often feature voices from local governments, environmental justice (EJ) groups, recyclers, composters, producers of covered materials, and more. Advisory Boards are often responsible for reviewing the program plan.

The Fee Structures

What is meant by the “fee structure”?

Each state will eventually have a list of its covered material categories and the associated fees per pound of each. Typically, fees are assigned to materials based on how expensive they are to dispose of properly. For example, recyclable paper products like corrugated cardboard carry low fees, while difficult-to-recycle packaging like expanded polystyrene (EPS, or Styrofoam) carry high fees. These fees can change year to year as costs to manage different materials change. These fees are usually called base fees.

The base fees alone create incentives to use less packaging and to use more recyclable materials. Some EPR laws may also implement incentives for other sustainability attributes for packaging called eco-modulated fees. These systems can create bonuses for materials that incorporate post-consumer recycled (PCR) content, have life cycle assessments (LCAs), and more.

As such, these fee structures in and of themselves do not ban certain types of packaging, but rather create economic incentives not to use them. For example, as mentioned above, EPS often carries very high fees, but is not explicitly banned. However, many EPR laws will include additional language that creates constraints, directly or indirectly, on different packaging types. For instance, California’s EPR law, known as SB 54, banned EPS food service ware as of January 1, 2025 because it was shown not to meet recycling rates outlined in the law. Additionally, many states will set recycling and recyclability targets that can create constraints. For example, SB 54 requires that 65% of all single-use packaging be recycled by 2032, and also requires that all packaging be reusable, recyclable, or compostable by 2032. This can create de facto restrictions on packaging materials that don’t meet any of those requirements.

Overall, the EPR fees and other constraints, such as recycling rates, create incentives for brands to reduce the amount of packaging they use and to switch to more recyclable or compostable packaging. These fees and recycling targets also create upstream incentives to incorporate circular principles early in a product’s production, rather than as an afterthought, as is traditionally done in a linear system.

Do we know what the fees are?

As of this writing, we have fee estimates in Oregon and Colorado, but not exact numbers. These estimates were released to help producers estimate their fee burdens.

To see Oregon’s fee estimates, look at their Program Plan starting on page 199. This schedule outlines a low and high base fee estimate. To see Colorado’s fee estimates, look at their Program Plan starting on page 184. This schedule presents a minimum and a maximum, but also shows averages for a low, medium, and high scenarios. See page 183 for more explanation of the different columns’ meanings.

Producers were required to submit their 2024 packaging usage data for Oregon to CAA by March 31, 2025. CAA will be invoicing producers based on these data by July 1, 2025, at which point we will know more about Oregon’s actual fees.

Producers need to submit data on their 2024 packaging usage for Colorado by July 31, 2025, and payments will be due by January 1, 2026. We will know more about Colorado’s actual fees by then.

What Brands Should Do Now

Immediate compliance tasks

The most important thing a producer can do is register with the PRO. At this time, it is free to join CAA, so if companies are unsure whether they should join, it would be better to go ahead and register. This will ensure the company will receive key information about deadlines and information on whether they will be obligated to pay fees. There may be a registration fee at some point. Producers can register at circularactionalliance.org/registration. Registration is straightforward and will require companies to appoint a primary point of contact as well as an authorized representative who can sign agreements between the company and CAA.

Registering with CAA itself does not require any packaging usage data to be submitted. For each state for which a company determines it is an obligated producer, it will sign a state-specific addendum with CAA and be given access to a portal through which to submit data.

From there, companies should understand their obligations in the states whose initial reporting deadlines have passed and those that are coming soon. As mentioned above, the original deadline to submit 2024 data for Oregon was March 31, 2025. Brands should consult with a legal team or consultant to determine if they are obligated in Oregon. If so, they should contact CAA to determine how to report late.

We anticipate that the state agencies will prioritize legal action against producers who fail to register and report, rather than against those who report late. We recommend registering and submitting data as soon as possible. Oregon, for instance, has a fine of up to $25,000 a day for non-compliance.

The other upcoming deadlines for EPR reporting are:

- Colorado: report 2024 data by July 31, 2025

- Companies will be invoiced based on this data by January 1, 2026

- California: report 2024 data in August 2025 (exact deadline TBD)

- Minnesota: register with CAA by July 1, 2025 (including signing Minnesota addendum)

- Maine: register with PRO and report data in May 2026

As of this writing, it is not yet clear when registration and data reporting will occur for Maryland and Washington.

Assign a point person at your company to register with CAA and stay on top of updates to EPR laws and implementation. Consider seeking legal counsel.

Long-Term Actions

While there is a great deal of uncertainty surrounding packaging EPR laws and implementation, there are a few things companies can do now to prepare:

- Understand your packaging data availability. Many companies have information available about their actual product specs, but don’t keep detailed information about the specs of the packaging associated with those products. Determine what information you have available about:

- What products you sell into specific states

- What kinds of packaging are used for the SKUs you sell into those states

- The weights of the packaging you use for those products

- You may not have all of the information necessary to calculate packaging weights. Consult internally about the most accurate way to estimate your packaging usage. CAA requires that you explain your calculation and estimation methodologies.

- Discuss how you can update your systems to account more precisely for what packaging each SKU uses. Consider using spec management software such as Specright to organize and export this information.

- Document all the ways you have reduced your packaging and/or made it more recyclable in the last 7-10 years. This could include recording any lightweighting, switching to recyclable packaging, PCR content use, etc. your company has done.

- Keep an eye out for any future opportunities to reduce your packaging and make it more recyclable – Atlantic Packaging can help with this! Check out our extensive sustainable packaging tools on our Sustainability page and on A New Earth Project’s website.

Keeping Up with EPR News

Several groups and media outlets maintain great information about the latest EPR news. Check out:

- Packaging Dive’s “EPR for packaging laws: Dates to know” maintains a list of upcoming deadlines and important dates

- CAA’s website’s state-specific pages have news and timeline updates – we recommend getting on their email list too

- Resource Recycling’s EPR coverage goes in-depth on the EPR news

Packaging EPR likely represents the biggest shift in packaging incentives in recent history, and we’ll help you stay on top of it here with more Deep Dives and resources in the future. In the meantime, here are some resources to dive even deeper:

- Link to our EPR one-pager

- EPR resource hub on our A New Earth Project website

State-Specific EPR Law Pages:

- California – “Plastic Pollution Prevention and Packaging Producer Responsibility Act” (SB 54)

- Colorado – “The Producer Responsibility Program for Statewide Recycling Act” (HB 22-1355)

- Illinois – “Statewide Recycling Needs Assessment Act” (SB 1555)

- Maine – “The Extended Producer Responsibility for Packaging Act” (LD 1541)

- Maryland – “Environment – Statewide Recycling Needs Assessment and Producer Responsibility for Packaging materials” (SB 222)

- Minnesota – “Packaging Waste and Cost Reduction Act” (HF 3911)

- Oregon – “Plastic Pollution and Recycling Modernization Act” (SB 582)

- Washington – “Recycling Reform Act” (SB 5284) (note: as of this writing, the Washington Department of Ecology does not yet have an EPR landing page. This summary presents the closest thing we have to an overview.)